Which Debt Repayment Option is Best for You?

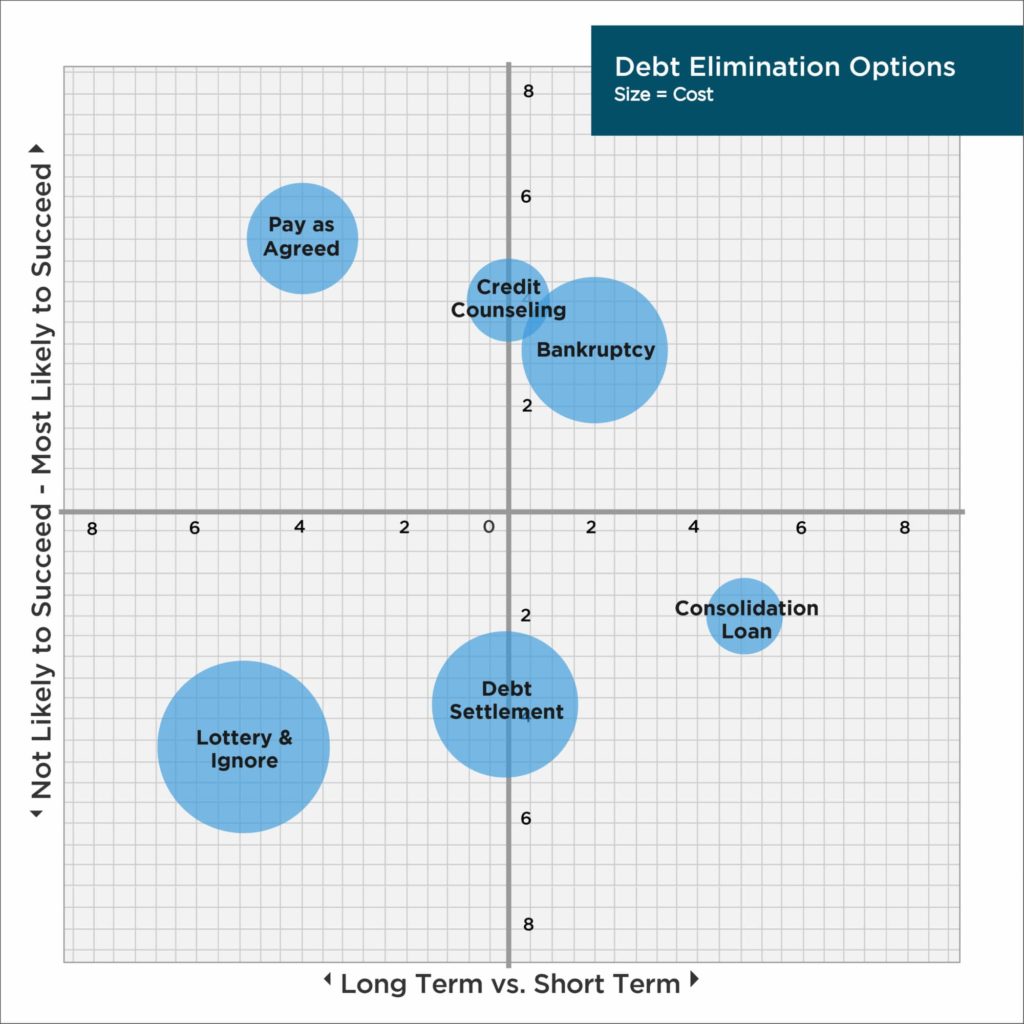

If there were an option to get out of debt quickly, painlessly and in a way that was likely to succeed, there really wouldn’t be so much confusion about how to get out of debt. There would be a tiny gleaming gold star in the top right-hand corner of the above graph. Unfortunately, there is no such option. Paying off debt, unlike getting into it, takes time or effort or extra money, or more likely all three.

Anyone wanting to get out of debt needs to answer the questions for themselves about how patient they are willing to be in paying off their debt, how much risk they’re willing to take to do so, and if they understand the potential consequences (pain and costs) associated with the option of their choice.

What Are Your Debt Repayment Options?

Pay as Agreed (DIY)

Generally, this is the best option for most people. It is highly effective and, unless penalty (“default”) rates and late or over limit fees are involved, it is also typically one of the cheaper options. If the debts involve interest rates in the mid-teens or higher, though, repaying an average $10,000 credit card debt will mean spending at least twice as much in interest to get rid of the debt (plus 25 to 30 years).

Credit Counseling Agency (Debt Management Program)

A Debt Management Program (DMP) through a nonprofit credit counseling agency (CCA) can be highly effective, especially for consumers with regular income and high-interest rates. The CCA negotiates lower interest rates and better repayment terms for the consumer with credit card debt, collections (medical or otherwise), payday loans, personal loans, old utility and cell phone accounts, etc. (exceptions are home loans and car loans, while students loan counseling may be provided separately). The debt has to be paid off in 5 years or less. There are some reasonable fees involved, though they are typically counterbalanced by the lower interest rates and the elimination of late fees. Of course, I’m going to highly recommend our agency, Debt Reduction Services, Inc. You can read more about why I recommend our agency in this article published on BadCredit.org.

Bankruptcy

Among the quickest and most reliable ways of getting rid of debt, bankruptcy is also generally held to be the most painful. It is the single worst event on our credit reports, meaning that any mortgage or other loans we try to qualify for in the following decade will be more expensive if even approved at all. Bankruptcy may also negatively impact one’s ability to get jobs (e.g. law enforcement, finance, government), one’s military security clearance, and even the premiums we pay for car insurance. While you can file for bankruptcy on your own, we highly recommend contacting an attorney who specializes in bankruptcy law. Yes, they charge a fee for their service, but you can call around and find a professional that will help you and work out the best payment arrangement for your circumstances.

Consolidation Loan

(Including a Home Equity Loan, a Line of Credit or a Credit Card Balance Transfer): There is a misconception that someone with a lot of credit card debt can find a consolidation loan to simplify the repayment process. There are three reasons consolidation loans are not usually a good option: 1) They are difficult to qualify for, since most lenders see them as highly risky loans, 2) They can carry some pretty hefty interest rates because of the risk the lender is taking, and/or 3) Most importantly, 70% of people who pay off their credit card debt with a consolidation loan or another credit card will run their credit card debts back up to their original balances within just two years.

Debt Settlement

Debt settlement companies (for profit or nonprofit) advise their clients to tell creditors to cease all contact. They then collect a monthly payment (including their own not-insignificant fees) until they feel they can offer about 50% of the original debt amount to the creditor in order to “settle” the debts. Settlement companies typically require their clients to owe at least $10,000 in debts. It’s certainly common that such clients end up sued by their creditors, who then can garnish the consumer’s wages and take a portion of their tax refund. Even in the small number of cases where such events are successful (usually held to be in the single-digit range), such an action has a significantly negative impact on the consumer’s credit rating. Finally, consumers have a difficult time finding a legitimate settlement company because regulators can hardly keep up with the fraudulent services. See the FTC warning here.

Win the Lottery

The odds of winning are so remote that I wish I didn’t have to address it. Unfortunately, millions still think they’re going to be the one, because, “hey, somebody’s gotta win, right?” One or two people usually win and make it on TV. What about the other 100 Million people? Do yourself a favor, see if you can win Deal or No Deal 3,000 times in a row without missing a single case, or get struck by lightning 7 times in a 15 year period and survive, and then you might just be lucky enough to play and win the lottery. Otherwise, take the $10 a week you might be spending on such gambling and invest it. You have probably a 95% chance of doubling your money. There’s probably even a 1% chance that you will have quadrupled it or more. Compared to the lottery, that’s as much of a sure bet as you’re going to get.

Ignore It

Closing your eyes in the midday sun does not make it night time. Unfortunately, too many consumers with debt essentially do the same thing. They hope that “something” will come along and help fix their debt problem. The reality is that the longer you wait, the worse the debt gets and the fewer the options you’ll have. After a couple months of late payments, credit card companies will likely raise their interest rates so high that Paying as Agreed will no longer be a possibility. After three or four months without making a payment, the consumer may not be able to get their account on a debt management program (although many collection agencies may still work with the CCAs).

Do You Have Questions About the Best Debt Repayment Option for You?

Call Debt Reduction Services today and get started on the road to living debt-free. Whether we can help you with our free budget and credit review counseling so you can pay off your debts on your own, or we can help get you repay your debt through our Debt Management Program.

Even if you think you might be looking at bankruptcy, each of these options can begin with a conversation with one of our certified counselors.

About the Author

Author and Accredited Financial Counselor®, Todd R. Christensen, MIM, MA, is the Education Manager for Debt Reduction Services, a nationwide nonprofit financial wellness and credit counseling agency. Todd develops educational programs and produces materials that teach personal financial skills and responsibilities to all ages. He’s also the author of the book Everyday Money for Everyday People.