We Can Consolidate your credit card debt into one simple monthly payment without a loan, and help you gain financial stability with our Credit Card Consolidation Plan.

Credit Card Debt Relief Program

Let’s Get In Touch

We’re a nonprofit debt relief organization licensed in all 50 states.

No Credit Check Required

Just a Few of the Creditors We Can Negotiate with On Your Behalf

Debt Reduction Services’s program is not a loan that replaces your existing debts with a new one. We’re here to act as your advocate and negotiate with your creditors on your behalf.

Reduce your monthly payments up to 50% and pay off credit card debt faster.

We have already negotiated reduced interest rates with all major creditors and most regional and local lenders in order to assist you in repaying your debt sooner than you would be able to on your own. Often, we’re able to leverage our existing relationships to stop your late and over-limit fees, and even lower your required monthly payments.

How it Works

Step 1.

Talk to one of our certified debt consolidation counselors.

Step 2.

Our preset terms with creditors can get you lower interest rates and payments.

Step 3.

Make just one simple monthly payment to us and we’ll distribute it to your creditors for you.

Call Now to Speak with a Certified Debt Relief Counselor

When you’ve got more credit card debt than you can keep up with, and you’re having a hard time making your monthly payments, a credit card debt relief program can help.

Finding the Right Solution to Your Credit Card Debt

Credit card debt relief comes in many forms and can change the amount of interest, penalties, and total debt that you owe so that you can get back in control of your finances.

But it is not always a magic bullet. There are many different debt relief programs out there, and not all of them are the right solution for everyone. It’s important to understand all of your options so that you can decide for yourself which option is truly the best one for you.

You Can Beat Overwhelming Credit Card Balances

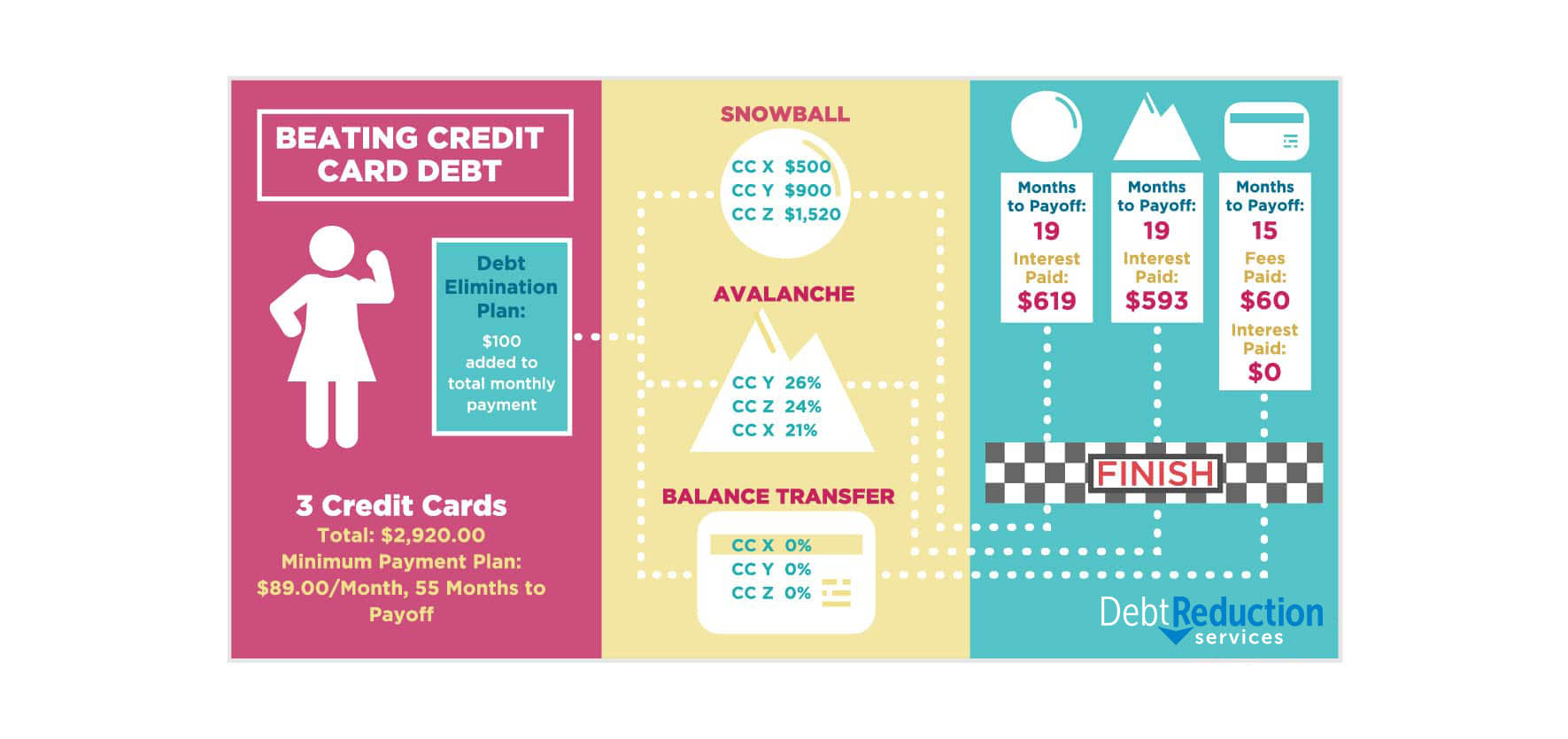

Your credit card balances aren’t going down, the minimum or slightly more than minimum payments are doing little to clear your debt, your credit score is stuck in neutral and you’re realizing that at this rate it will be many years until you can wipe the slate clean and start fresh with no balances. You’d like to pay your credit card debt off fast, but rather than waiting for help from your taxes, or from an increase in salary, you want to start seeing progress now. The following tips can help you expedite paying your credit cards, but it won’t be easy. Quick fixes can likely lead you to additional trouble down the road and detour you from your path to truly becoming debt free. Instead, stick to these tried and true methods and you will see real, long-lasting results.

How to Pay Off Credit Card Debt

You’ve already committed to paying your credit card debt off, but where to start? First, you’ll need to assess your situation in detail. Putting together one consolidated view of your credit cards by compiling information such as who you owe, how much you owe, the minimum monthly payments and the annual percentage rate of each will give you an idea of where to begin. Once gathered, you will be able to recognize which debts to prioritize whether it is the smallest balance, the highest interest, or the one pressuring most for payment.

To begin, we identify the type of debt you require assistance with. At Debt Reduction Services / Moneyfit, our Debt Management Plan specializes in consolidating unsecured accounts, including credit cards, payday loans, medical debt, and collections. However, it’s important to note that debts secured by collateral, such as cars, boats, or homes, are not eligible for consolidation through this plan.

The next step is to move forward with paying down your debt. It is important to face repayment with a specific strategy and to understand what you can really afford to put towards your debt, once sacrifices are made and unnecessary expenses are eliminated from your spending. It may not be possible to make more than a minimum payment to each credit card in this early stage, but any monthly payment is progress in the right direction. While balances may be slow to show the difference, your credit score will benefit and creditors, in acknowledgment of your effort, will spare you from a headache that having a debt in collections can be.

Next, you’ll find several popular and certifiably safe paths that can be used to provide you with long-term relief and help you to wipe out your debt in full.

Remember, in combination with these methods, you’ll want to take a hard look at your spending habits and cut out needless purchases to prevent future accumulation of debt. It might even be helpful to put all credit or borrowing activities on hold.

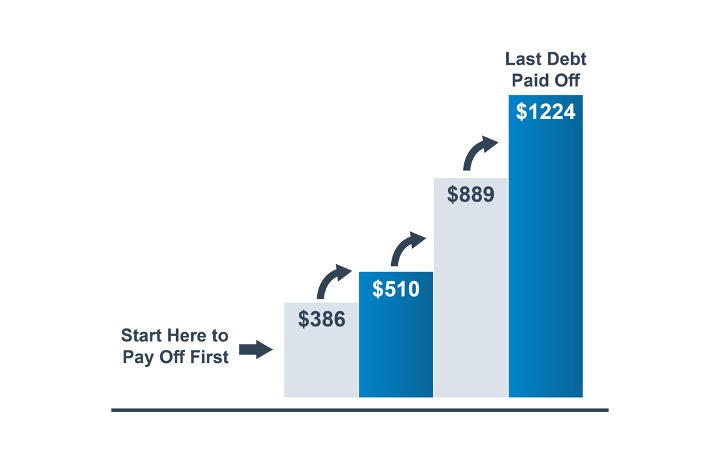

Eliminate the Smallest Debt First

You might consider this method if you are stressed about the long list of debts you have to manage. Putting this plan into action will help you reduce that number faster.

Start by reviewing your expenses over the last month. Add up all the bills you need to pay in order to live including housing, groceries, gas, and utilities. Subtract this from your total monthly income and you can begin to get an idea of how much could be allocated to your credit card debt. Next, add up the amount of all the minimum payments due. Compare these two numbers. If you cannot cover the total for the minimum payments required, you might need to make deeper cuts in your budget, perhaps being more frugal with your gas or groceries this next month. If you find your amount left over is larger than your payments combined, you’ll want to add the excess remaining toward the smallest debt on your list. Finally, proceed with payments. Apply the largest payment to the card with the smallest balance and you’ll eliminate the debt with efficiency.

Be sure to roll over payments to the next account once the targeted balance has reached zero and you’ll be able to shrink your list of debts one by one. Don’t forget to continue making minimum payments on all other cards or accounts as part of this plan, as this will reduce their starting balance when it comes time to knock them out.

If you have 3 cards or less to repay and high interest has been the thorn in your side, then attacking the balance with the highest interest rate might serve you better and save you more. Learn more in the next section.

Success Stories

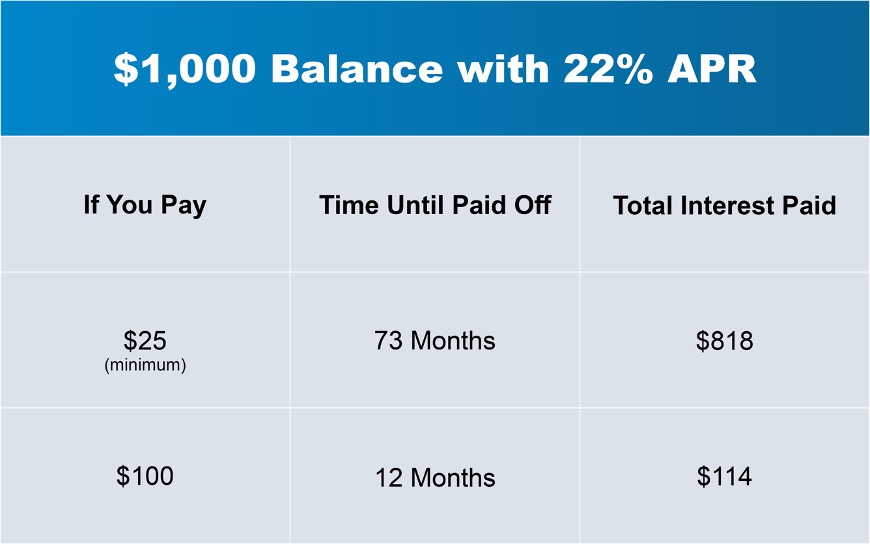

Make the Biggest Payment to Debt with the Highest Interest Rate

It may have felt oh so good to cover a purchase you didn’t think you could afford with the swipe of your credit card. Then, high interest kicked in and what you owe seems insurmountable. You’ve learned that not only were you unable to afford your purchase at its original price but with your credit card’s added interest, it has become more of a stress than the pleasure you thought it was worth. If you are determined to stick it to high interest and you are motivated to tackle your debt once and for all, then this method is sure to see you to your goal.

Unlike paying the smallest balance, your progress will seem less apparent. Realize that your victory against high-interest rates and fees might not be reflected in your month to month account balance, but will instead be in the possible thousands of dollars you save in interest over time. Try to visualize this for a more tangible sense of success. For example, paying an extra $100 a month toward a $12,000 balance with an interest rate as low as 4% will save almost $1,000 over the lifetime of the repayment. Your interest rate is likely much higher, and therefore your savings will be too.

These two repayment options are not the quickest or most glamorous routes to settling your credit card debt, but they are among the most successful and effective. Both transferring your balance and seeking a loan are considered to be alternative methods.

As in the previous method, list out your credit card balances, starting with the card with the highest interest rate or most painful fees and work your way to the card with the least. Begin, again, by delivering the largest payment towards your top account and applying only the minimum payment to the remaining accounts on your list. Once the first card has been paid in full, move on to the next biggest offender.

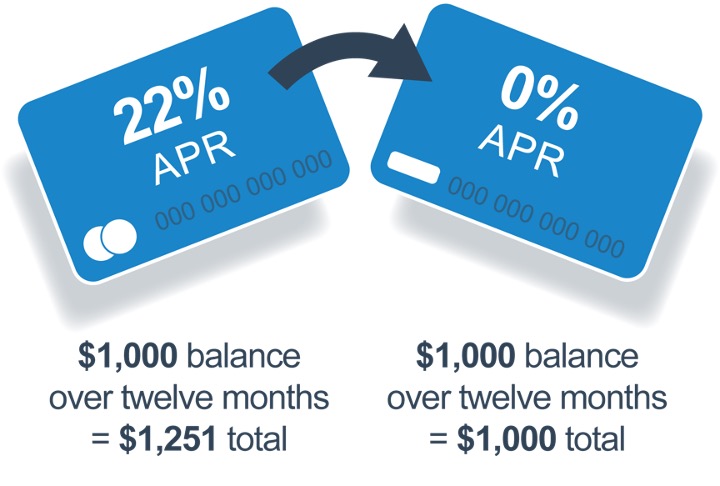

Transfer Your Debt

As an easy answer to an overwhelming problem, many have turned to balance-transfer credit cards for debt relief. These cards promise an introductory APR of 0% for a specified amount of time if you transfer your balance from your current card to their card. There are many types available, each with their own fine print designed to benefit not you, but the credit card companies.

Opening a balance-transfer card does sometimes save money by dodging the high interest on your debt from a previous card. It also may buy some time to create a plan to repay your debt. However, it does nothing to reduce your current balance.

You might also fall victim to a balance transfer fee, an imposed timeline for your balance to be paid in full, or a higher APR than you had before. In a sense, using balance transfer cards is a way to trade one form of debt for another. It will ultimately only prolong your journey to financial freedom. For this reason, we do not recommend it as a repayment method.

What to Do if You Need Help with Credit Card Debt

When it comes to your credit card debt, you might feel as though you’ve passed the point of return. You have no idea where your balances stand, you can’t seem to break your dependency on credit, let alone pay down your existing debt, and you are trapped in what seems a never-ending cycle. Attempting repayment on your own may seem far too complicated and you might worry about accomplishing it the right way.

If this is the situation you find yourself in, it may be time to seek additional help. Whether your income seems too small, your budget too tight, your debt too large, or your accounts owed too many, with expert guidance, a solution to your debt can be found. Financial education is the key to your success and credit counseling is one way to regain power over your finances and debt.

Utilize Credit Card Debt Counseling

Credit counseling is a no-cost opportunity to speak with a certified individual who can answer your questions and fully assess your financial picture. Once reviewed, your credit counselor will suggest how you can revise your budget in order to prevent more debt and explain possible options for debt relief including debt management programs that can get you lower interest rates and lower monthly minimums with your creditors.

In addition to these great benefits, licensed nonprofit credit counseling agencies will provide you with information and resources, such as instructions for accessing your credit report and money management classes, to assist you toward healthier finances in the future.

As you work toward paying down your debt, your credit counseling agency offers you support and assistance all along the way.

Becoming informed is always a good start. However, if you feel you need help beyond counsel, credit counseling agencies can also give you information regarding debt management plans (DMP) that provide a structured repayment plan individual to your needs and ability.

Unlike credit counseling, DMPs do require a fee for enrollment and continued monthly services. However, your finances are always taken into account to ensure that your plan is not only affordable, but also effective in resolving your debt. Because debt consolidation companies have strong agreements with a wide variety of creditors, they can save you more money in interest on your debt than if you attempted repayment on your own. They also guarantee your debt will be repaid in 5 years or less as required by governmental regulation.

Enroll in a Debt Consolidation (Management) Program

When you’ve got more credit card debt than you can keep up with, and you’re having a hard time making your monthly payments, a debt consolidation program can offer relief. At Debt Reduction Services, we offer a debt consolidation program to help people consolidate their debts into one lower monthly payment so that they can get back in control of their finances. Unlike credit counseling, DMPs do require a fee for enrollment and continued monthly services. However, your finances are always taken into account to ensure that your plan is not only affordable, but also effective in resolving your debt. Just a few of the benefits of Credit Card consolidation with a DMP include:

- Lower Interest Rates & Lower Payments: Ability to pay off the accounts at lower interest rates and affordable monthly payments with preset terms provided by the creditors.

- Stop Over Limit & Late Fees: Once an account is setup on a DMP, those fees will stop accruing.

- Stop Collection Calls

- One Convenient Monthly Payment: All the credit card debts will be consolidated into one monthly payment to us that we will disburse to each of the creditors.

- Timeframe That Provides Your Debt Will be Repaid in 5 years or Less as Required by Governmental Regulation

- Paying the Debt in Full: All of the debt will be paid in full over the course of the program, which minimizes the negative effect to your credit.

Getting Started

Whether you need some help budgeting or your income doesn’t quite cover your credit card payments every month, a debt management program can be a great step towards becoming debt-free. When you work with a nonprofit credit counseling agency, you’re no longer facing your debt alone. Instead, you have a team of experienced professionals on your side.